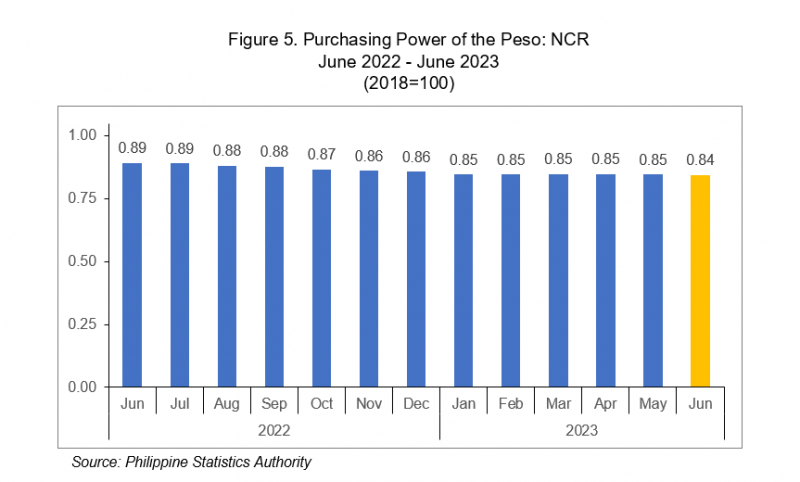

Consumer Price Index in NCR upticks to 118.4 percent

The CPI in NCR this June 2023 upticked to 118.4 percent from 118.1 percent in the previous month. On a yearly basis, the CPI increased by 6.2 percentage points during the month from 112.2 percent in June 2022. The CPI in NCR consistently remained below the Philippines’ record settling at 121.1 percent, up by 0.2 percentage points from its 120.9 percent index in May 2023.

The CPI of 118.4 percent in June 2023 indicated that consumer prices, on average, had increased by 18.4 percent from the base year 2018. This can also be interpreted that a basket of commodities that can be purchased at PhP100.00 by an average Filipino household in NCR in 2018 can be bought at PhP118.4 in June 2023. (Figure 1)

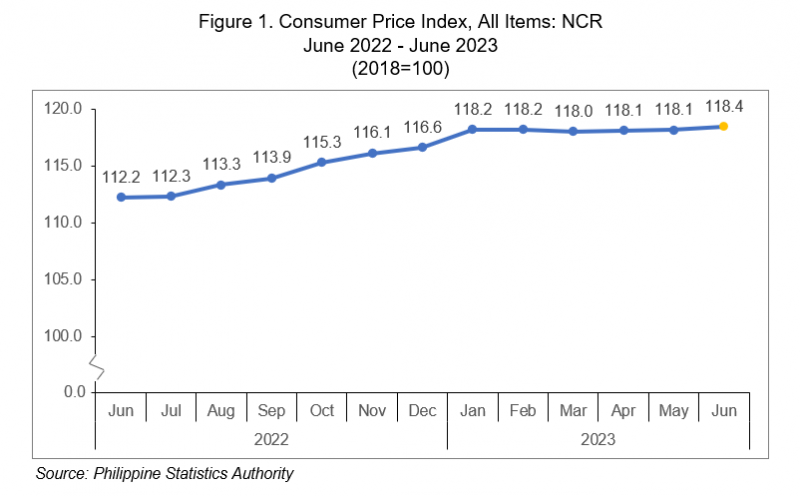

Inflation rate in NCR slides further to 5.6 percent

The inflation rate in NCR slid further to 5.6 percent in June 2023, down by 0.9 percentage points from 6.5 percent in May 2023. In June 2022, the inflation rate was also recorded at 5.6 percent. The average inflation for the first six (6) months of 2023 stood at 7.38 percent. (Figure 3)

At the national level, the headline inflation rate for the Philippines likewise slowed down to 5.6 percent in June 2023 from 6.1 percent in May 2023. Moreover, slower inflation was also observed in all other regions. Among the regions that registered slower inflation, Region IX (Zamboanga Peninsula) recorded the most with a 1.3 percentage points decline in their respective inflation rates this month compared to May 2023. This was followed by National Capital Region (NCR), Region I (Ilocos Region) and Region VIII (Eastern Visayas) with a decline of 0.9 percentage points.

Index of Food and Non-Alcoholic Beverages draws slower inflation in NCR

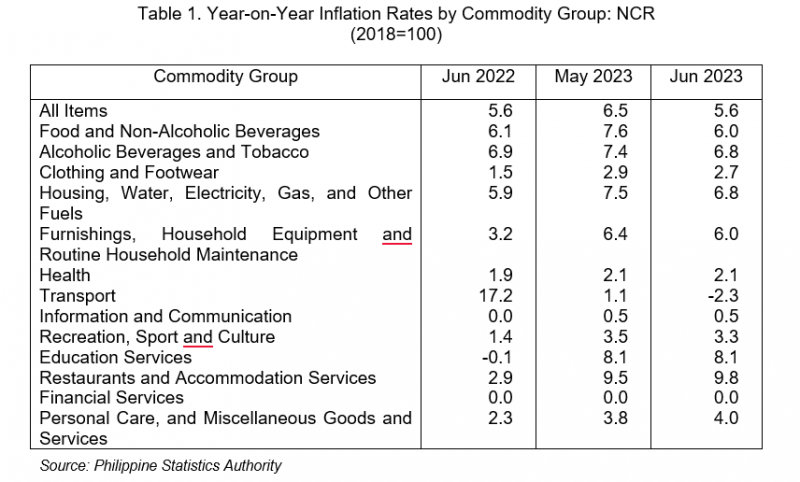

The index of food and non-alcoholic beverages drew slower inflation in NCR with 1.6 percentage points dropped from its 7.6 percent inflation rate in

May 2023 to reach 6.0 percent this June 2023. This contributed to around 48.7 percent of the downtrend in inflation. The index of transport commodity group came next which inflation rate contracted to -2.3 percent, down by 3.4 percentage points from 1.1 percent in May 2023 and contributed around 28.4 percent to the slowdown in inflation. This was followed by the index of housing, water, electricity, gas, and other fuels with an inflation rate of 6.8 percent this June 2023 from 7.5 in the previous month.

In addition, lower inflation rates were observed in the indices of the following commodity groups during the month:

a. Alcoholic beverages and tobacco, 6.8 percent from 7.4 percent;

b. Clothing and footwear, 2.7 percent from 2.9 percent;

c. Furnishings, household equipment and routine household maintenance, 6.0 percent from 6.4 percent; and

d. Recreation, sport and culture, 3.3 percent from 3.5 percent.

In contrast, higher annual markups were noted in the following commodity groups during the month:

Restaurants And Accommodation Services, 9.8 percent; and

Personal care, and miscellaneous goods and services, 4.0 percent.

Meanwhile, the indices for the rest of the commodity groups continued to move at their respective rates in June 2023. (Table 1)

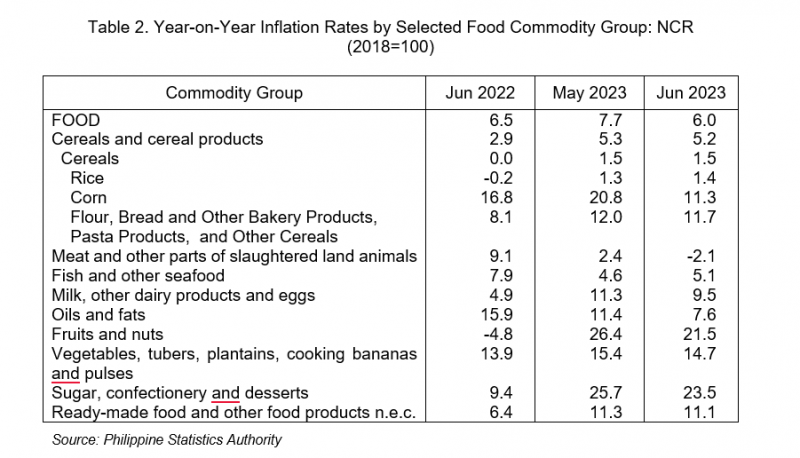

Food inflation decelerates further to 6.0 percent

Inflation of food continued its downward trend as it decelerated further to 6.0 percent in June 2023 from 7.7 percent in May 2023. The index of meat and other parts of slaughtered land animals was the main contributor to slower food inflation as its annual increment contracted to -2.1 percent from 2.4 percent in May 2023. This was followed by the index of fruits and nuts with an annual dip of 4.9 percentage points this month from 26.4 percent in May 2023 to 21.5 in June 2023 and the index of milk, other dairy products and eggs with 9.5 percent from 11.3 percent in the previous month.

Moreover, other food commodity groups that contributed to slower food inflation were the following:

a) Corn, 11.3 percent;

b) Flour, bread and other bakery products, pasta products, and other cereals,11.7 percent;

c) Oils and fats, 7.6 percent;

d) Vegetables, tubers, plantains, cooking bananas and pulses,14.7 percent;

e) Sugar, confectionery and desserts, 23.5 percent; and

f) Ready-made food and other food products n.e.c., 8.5 percent.

On the other hand, higher annual hikes were noted in the indices of the following food commodity groups during the month:

a) Rice, 1.4 percent; and

b) Fish and other seafood; 5.1 percent; (Table 2)

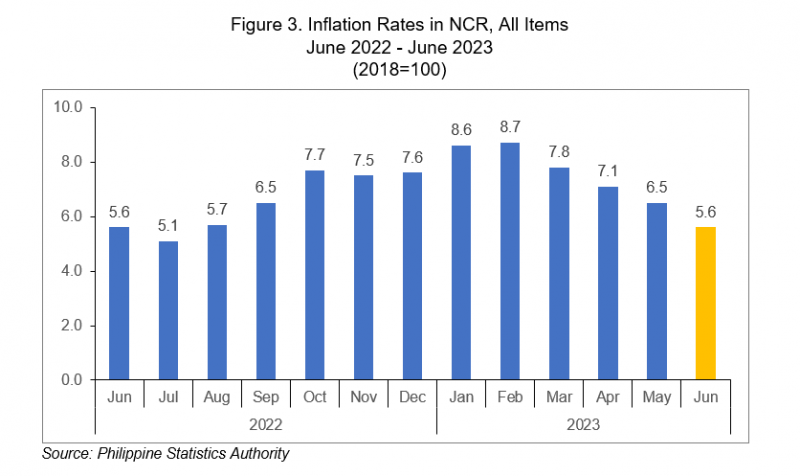

Purchasing Power of Peso (PPP) slightly decreases at 0.84

The PPP is a measure of the real value of the peso in a given period relative to a chosen reference and is computed by getting the reciprocal of the CPI and multiplying the result by 100. The PPP is inversely related to the CPI thus an increase in the CPI will result in a decrease in the PPP.