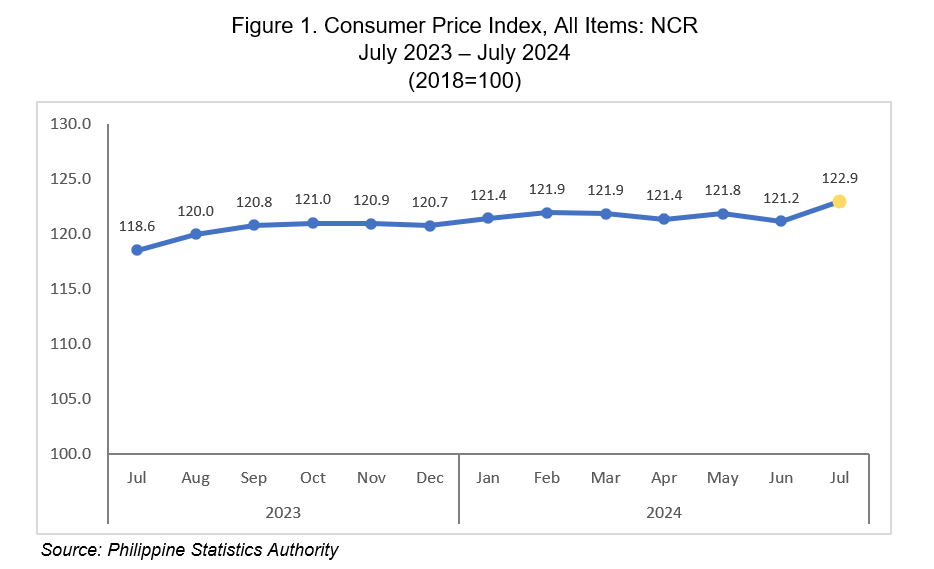

The Consumer Price Index (CPI) for the National Capital Region (NCR) increased to 122.9 percent in July 2024, up from 121.2 percent in June 2024, indicating a 1.7 percentage increase over the month. Compared to the previous year, the CPI rose by 4.3 points from 118.6 in July 2023. Throughout this timeframe, the NCR's CPI consistently stayed below the overall CPI at the national level, which reached 126.5 percent in July 2024 from 125.6 in the previous months.

Inflation rate in NCR accelerates to 3.7 percent

In July 2024, the inflation rate in the NCR moved faster at 3.7 percent, up from 2.3 percent in the previous month. This represents a 1.4 percentage points rise compared to June 2024. In comparison, the inflation rate in July 2023 was higher, at 5.6 percent. (Figure 2)

Similarly, on a national scale, inflation in the Philippines saw a slight increase to 4.4 percent in July 2024 from 3.7 percent in June 2024. The upward trajectory in inflation can be observed across fourteen (14) out of the seventeen (17) regions. NCR observed the most significant increase in its inflation rate, with a rise of 1.4 percentage points. This was followed by Region XI (Davao Region) and Region XII (SOCCSKSARGEN), each experiencing an increase of 0.8 percentage points.

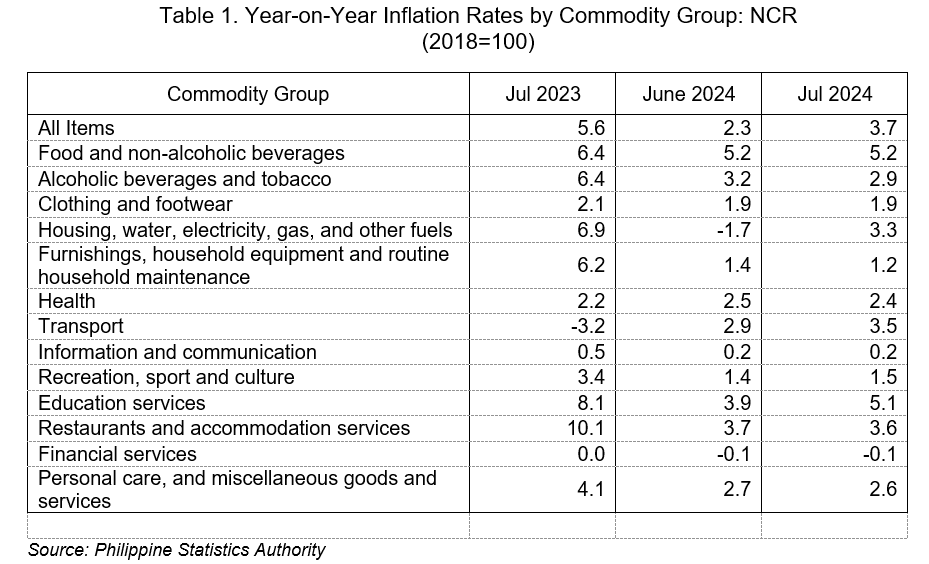

Housing, water, electricity, gas, and other fuels drives acceleration of inflation in the NCR

The index of housing, water, electricity, gas, and other fuels was the main driver to the acceleration of the inflation in NCR as it rebounded to 3.3 percent from negative 1.7 percent in June 2024. The increase in the inflation rate in housing, water, electricity, gas, and other fuels contributed to around 94.5 percent of the overall uptrend in inflation for the month. Also contributing to the uptick in inflation in the area was the increase in the transport commodity group at 3.5 percent during the month from 2.9 percent in the previous month and was followed by the index of education services which increased to 5.1 percent in July 2024 from 3.9 percent in June 2024. Moreover, higher year-on-year markups were noted in the index of recreation, sport and culture with 1.5 percent from 1.4 percent in June 2024.

In contrast, lower annual increments during the month were observed in the indices of the following commodity groups:

a) Alcoholic beverages and tobacco at 2.9 percent;

b) Furnishings, household equipment and routine household maintenance, 1.2 percent;

c) Health, 2.4 percent;

d) Restaurants and accommodation services, 3.6 percent; and

e) Personal care, and miscellaneous goods and services, 2.6 percent

The indices of the rest of the commodity groups moved at their respective annual rates in July 2024. (Table 1)

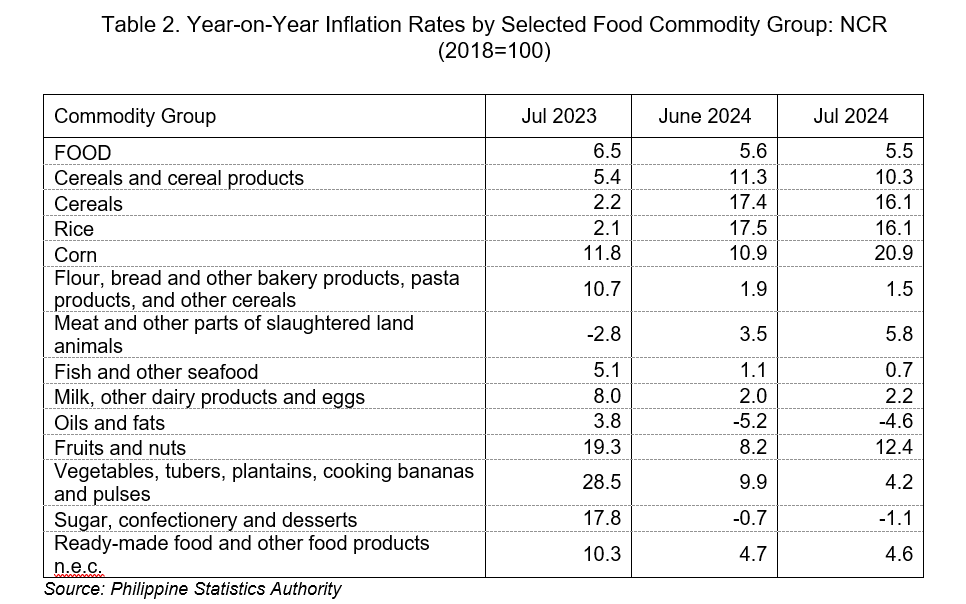

Food inflation eases to 5.5 percent

Inflation of food eased to 5.5 percent this July 2024, recording a 0.1 percentage point decrease from 5.6 percent inflation in the previous month. The downtrend of food inflation was mainly brought by the lower year-on-year growth rate in the index of vegetables, tubers, plantains, cooking bananas and pulses which decreased further to 4.2 percent inflation in July 2024 from 9.9 percent in June 2024. This was followed by the index of rice which registered an annual decrease of 16.1 percent inflation this month from 17.5 percent in June 2024 and the commodity group of fish and other seafood which registered lower inflation from 1.1 percent in the previous month to

0.7 percent in July 2024.

Similarly, the following three food commodity groups also exhibited lower inflation this month:

a) Flour, bread and other bakery products, pasta products, and other cereals,

1.5 percent;

b) Sugar, confectionery and desserts, -1.1 percent; and

c) Ready-made food and other food products n.e.c., 4.6 percent

On the other hand, the following food commodity groups observed an uptick in inflation during this month:

a) Corn, 20.9 percent;

b) Meat and other parts of slaughtered land animals, 5.8 percent;

c) Milk, other dairy products and eggs, 2.2 percent;

d) Oils and fats, -4.6 percent; and

e) Fruits and nuts, 12.4 percent

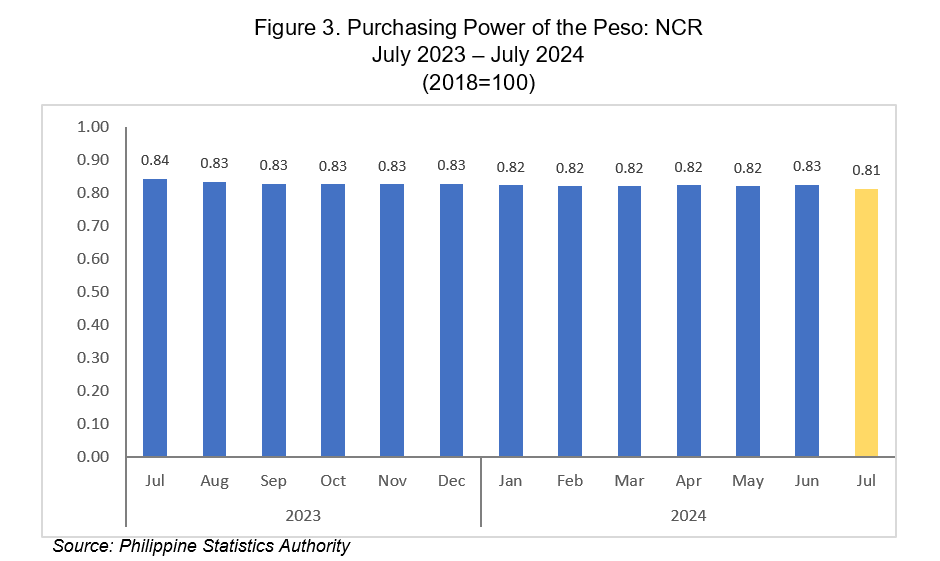

Purchasing Power of the Peso (PPP) decreases to 0.81

The PPP is a measure of the real value of the peso in a given period relative to a chosen reference period and is computed by getting the reciprocal of the CPI and multiplying the result by 100. The PPP is inversely related to the CPI thus an increase in the CPI will result in a decrease in the PPP.

In July 2024, the PPP in NCR slightly decreased to 0.81 from 0.83 from the previous month. The PPP in July 2023 was at 0.84. (Figure 3)

PACIANO B. DIZON

Regional Director