Consumer Price Index in NCR slides to 118.0 percent

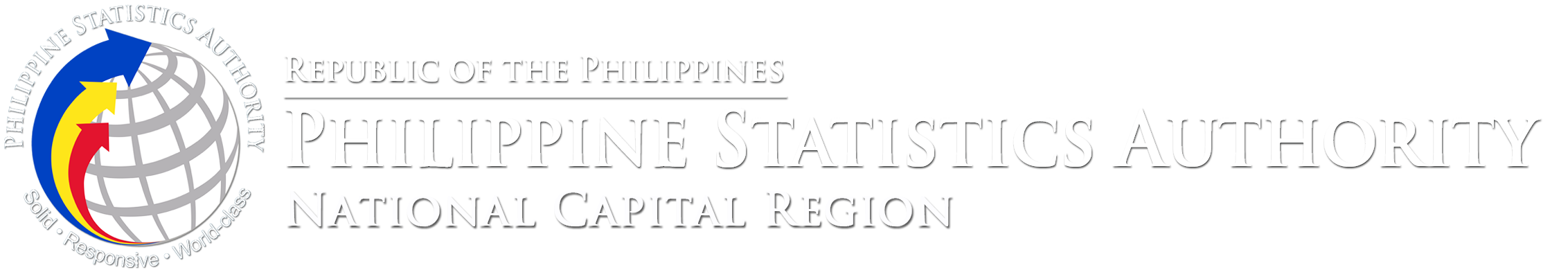

The CPI in NCR this March 2023 slid to 118.0 percent from 118.2 percent in the previous month. On yearly basis, the CPI increased by 8.5 percentage points during the month from 109.5 percent in March 2022. The CPI in NCR consistently remained below the Philippines’ record which settled at 121.1 percent, lower by 0.3 percentage point than its 121.4 percent index in February 2023.

The CPI of 118.0 in March 2023 indicated that consumer prices, on average, had increased by 18.0 percent from the base year 2018. This can also be interpreted that a basket of commodities that can be purchased at PhP100.00 by an average Filipino household in NCR in 2018 can be bought at PhP118.0 in March 2023. (Figure 1)

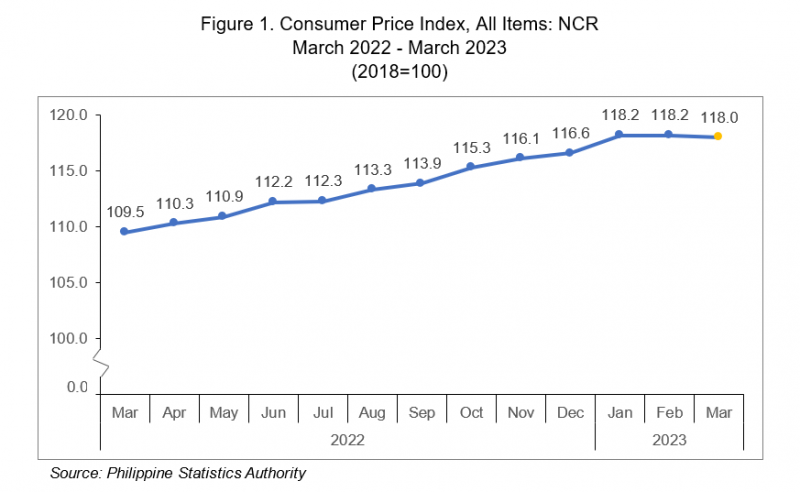

At the national level, 12 more regions registered lower CPI in March 2023 compared to their previous month’s level. Among the regions with lower CPI, the Cordillera Administrative Region (CAR) registered the steepest decline of 1.1 percentage points or from 120.0 percent in February 2023 to 118.9 percent in March 2023. This was followed by Region V (Bicol Region) and Region IX (Zamboanga Peninsula) with a 1.0 percentage point and 0.9 percentage point decrease in their CPI, respectively.

On the other hand, three regions registered an increase in the CPI led by Bangsamoro Autonomous Region in Muslim Mindanao (BARMM) with a 0.9 percentage point increase from 119.3 percent in February to 120.2 percent this month. This was followed by Region XII (SOCCSKSARGEN) and MIMAROPA Region which registered an increase of 0.3 percentage point and 0.2 percentage point, respectively. Meanwhile, the CPI of Region XI (Davao Region) remained at the same level as that of its previous month’s record of 122.4 percent. (Figure 2)

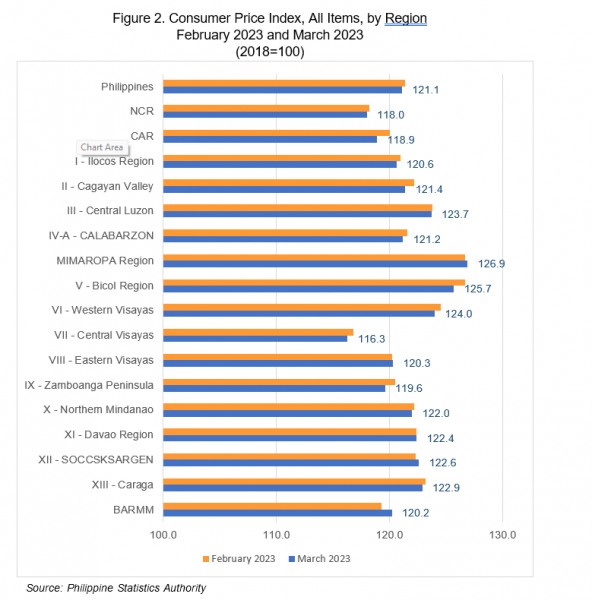

Inflation rate in NCR slows down to 7.8 percent

The inflation rate in NCR slowed down to 7.8 percent in March 2023, down by 0.9 percentage point from 8.7 percent in February 2023. In March 2022, the inflation rate was lower at 3.4 percent. The average inflation for the first quarter of 2023 stood at 8.4 percent. (Figure 3)

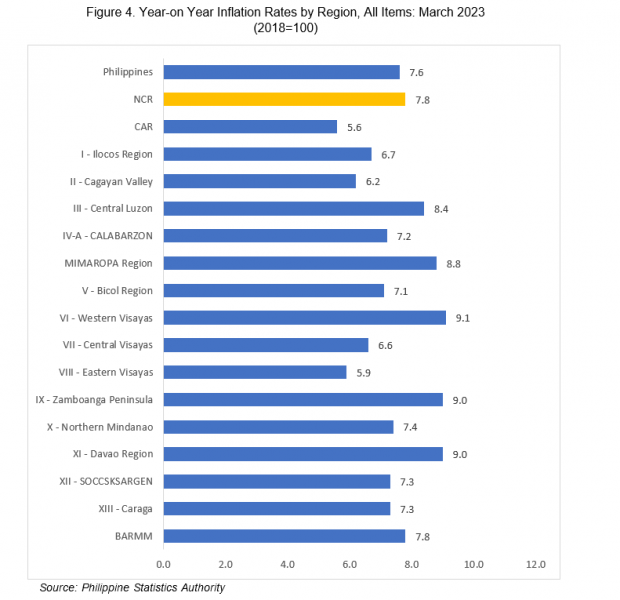

At the national level, the headline inflation rate for the Philippines likewise slowed down to 7.6 percent in March 2023 from 8.6 percent in February 2023. Moreover, slower inflation was also observed in all other regions, except BARMM which registered an uptick of 0.3 percentage point in its inflation rate this March 2023 compared to the previous month. Among the regions that registered slower inflation, Region V (Bicol Region), Region VI (Western Visayas), and Region II (Cagayan Valley) recorded the most with a 1.7 percentage points decline in their respective inflation rates this month compared to February 2023.

Across all regions, Region VI (Western Visayas) remained with the highest inflation rate at 9.1 percent followed by Region IX (Zamboanga Peninsula) and Region XI (Davao Region) with both 9.0 percent. On the other hand, regions with the lowest inflation rates were Cordillera Administrative Region (CAR) at 5.6 percent, Region VIII (Eastern Visayas) at 5.9 percent, and Cagayan Valley at 6.2 percent. (Figure 4)

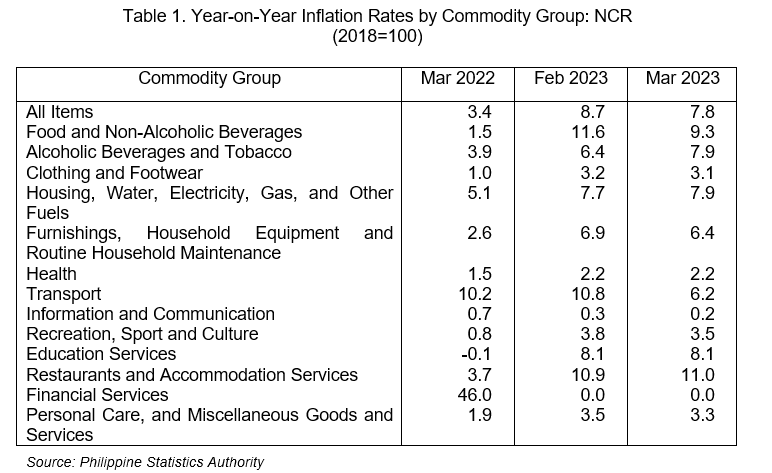

Index of food and non-alcoholic beverages draws slower inflation in NCR

The index of food and non-alcoholic beverages drew slower inflation in NCR with 2.3 percentage points dropped from its 11.6 percent inflation rate in February 2023 to reach 9.3 percent this March 2023. This contributed to around 62.5 percent of the downtrend in inflation. The index of transport commodity group came next with an inflation rate of 6.2 percent, down by 4.6 percentage points from 10.8 percent in February 2023 and contributed around 34.3 percent to the slowdown in inflation.

Lower annual markups were also noted in the following commodity groups during the month:

Clothing and footwear, 3.1 percent;

Furnishings, household equipment and routine household maintenance,

6.4 percentInformation and communication, 0.2 percent;

Recreation, sport and culture, 3.5 percent; and

Personal care, and miscellaneous goods and services, 3.3 percent.

In contrast, higher annual increments during the month were observed in the indices of alcoholic beverages and tobacco at 7.9 percent; housing, water, electricity, gas, and other fuels also at 7.9 percent; and restaurants and accommodation services at 11.0 percent. The indices for the rest of the commodity groups continued to move at their respective rates in February 2023. (Table 1)

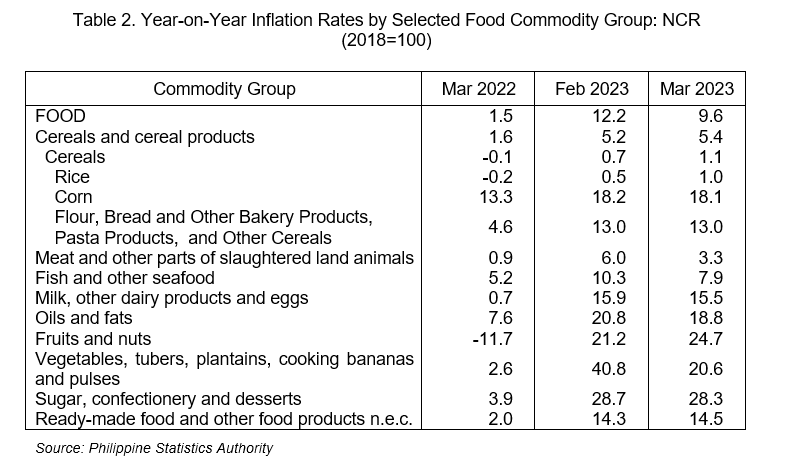

Food inflation decelerates to 9.6 percent

Inflation of food continued to move downward as it decelerated further to 9.6 percent in March 2023 from 12.2 percent in February 2023. Similar to the previous month, the index of vegetables, tubers, plantains, cooking bananas and pulses remained as the main contributor to slower food inflation as its annual increment dipped further to 20.6 percent from 40.8 percent in February 2023. This was followed by the index of meat and other parts of slaughtered land animals with an annual increment of 3.3 percent this month from 6.0 percent in February 2023 and the index of fish and other seafood with 7.9 percent from 10.3 percent in the previous month. Moreover, other food commodity groups that contributed to slower food inflation were the following:

Corn, 18.1 percent;

Milk, other dairy products and eggs, 15.5 percent;

Oils and fats, 18.8 percent; and

Sugar, confectionery and desserts, 28.3 percent.

On the other hand, higher annual hikes were noted in the indices of the following food commodity groups during the month:

Rice, 1.0 percent;

Fruits and nuts, 24.7 percent; and

Ready-made food and other food products n.e.c., 14.5 percent. (Table 2)

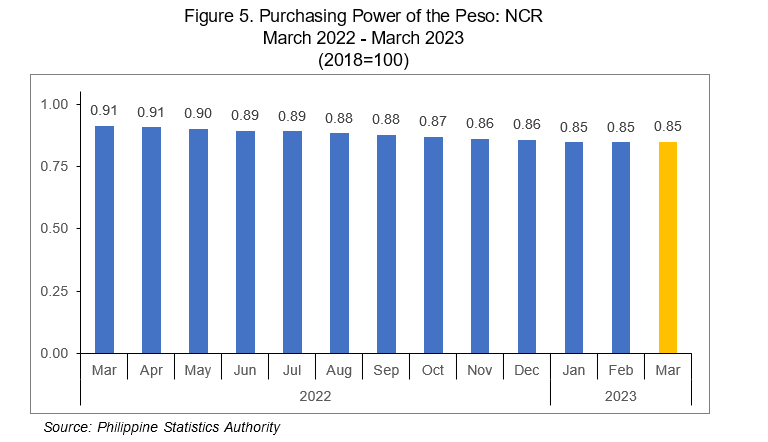

Purchasing Power of the Peso (PPP) remains at 0.85

The PPP is a measure of the real value of the peso in a given period relative to a chosen reference and is computed by getting the reciprocal of the CPI and multiplying the result by 100. The PPP is inversely related to the CPI thus an increase in the CPI will result in a decrease in the PPP.

The PPP in NCR remained at 0.85 in March 2023. This was the third consecutive month that the PPP stood at 0.85. This means that a peso in 2018 was worth 85 centavos in March 2023. The PPP in March 2022 was higher at 0.91. (Figure 5)

SGD.

PACIANO B. DIZON

Regional Director

TECHNICAL NOTES

Consumer Price Index

The Consumer Price Index (CPI) is an indicator of the change in the average retail prices of a fixed basket of goods and services commonly purchased by households for their day-to-day consumption relative to a base year.

Components of the CPI

Base Period

This is a reference date or simply a convenient benchmark to which a continuous series of index numbers can be related. Since the CPI measures the average changes in the retail prices of a fixed basket of goods, it is necessary to compare the movement in previous years back to a reference date at which the index is taken as equal to 100. The present series of CPI uses 2018 as the base period or base year.

Market Basket

Market basket refers to a sample of goods and services commonly purchased by the households.

The commodities included in the 2018-based CPI market basket are the modal

commodities which were considered as the most commonly purchased/availed of commodities by the households. The composition of the market basket was determined based on updating the 2012 basket using the results of the 2021 Survey of Key Informants (SKI). In NCR, a total of 760 commodities are included in the market basket.

Weighting System

The weights for the 2018-based CPI were derived from the expenditure data of the 2018 Family Income and Expenditure Survey (FIES). The weight for each commodity/group of commodities is the proportion of the expenditure of the expenditure of commodity/group of commodities to the total national expenditure. The sum of the weights of the commodity groups at the national level is equal to 100.

Inflation Rate

The inflation rate is the annual rate of change or the year-on-year change in the Consumer Price Index.

Purchasing Power of the Peso

The Purchasing Power of the Peso (PPP) is a measure of the real value of the peso in a given period relative to a chosen reference period. It is computed by getting the reciprocal of the CPI and multiplying the result by 100.