Consumer Price Index in NCR reaches 125.0

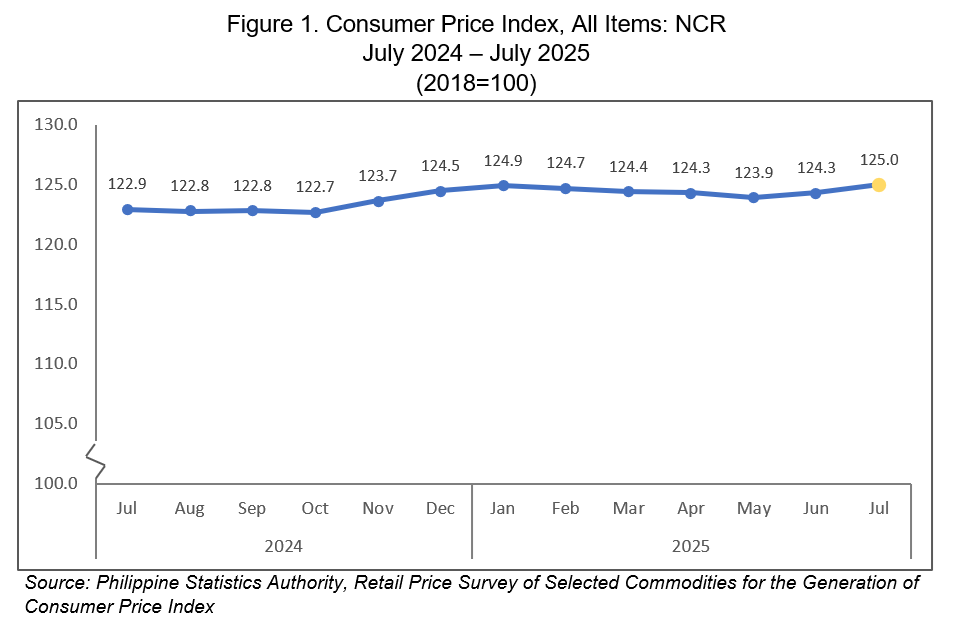

The Consumer Price Index (CPI) in the National Capital Region (NCR) increased to 125.0 in July 2025, from 124.3 in June 2025. This is the second increase from the previous four-month streak of declines observed in the preceding months. Moreover, the NCR's CPI rose by 2.1 index points compared to 122.9 in July 2024. The region’s CPI remained below the national average, which grew to 127.7 in July 2025, compared to 127.3 in the previous month.

The CPI of 125.0 in July 2025 signifies that, on average, the prices of goods and services in the region have increased by 25.0 percent relative to the base year of 2018. In practical terms, a basket of goods and services that cost PhP100.00 for a typical Filipino household in NCR in 2018 would have cost approximately PhP125.0 in July 2025. (Figure 1)

The inflation rate in NCR eases to 1.7 percent

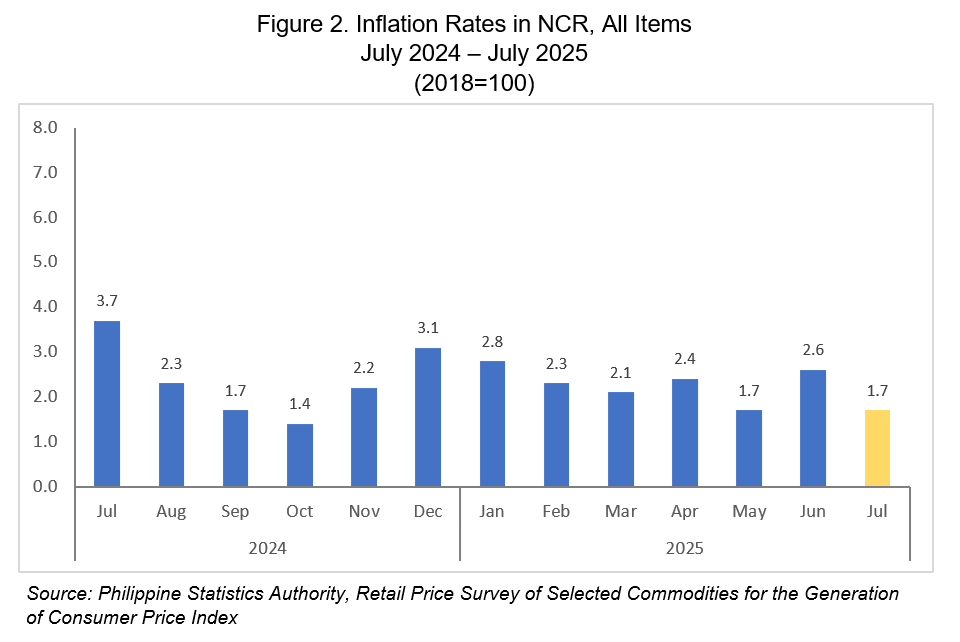

In July 2025, the inflation rate in the NCR moved to a slower rate at 1.7 percent, from 2.6 percent in June 2025. This 0.9 percentage point decrease represents the sharpest monthly deceleration in inflation since January 2025. In July 2024, inflation rate in the region was recorded at 3.7 percent. (Figure 2)

Similarly, the headline inflation at the national level decreased to 0.9 percent in July 2025 from 1.4 percent in June 2025, still lower than the inflation rate in the NCR.

Several regions experienced a decrease in inflation. Region II (Cagayan Valley) recorded the highest dip with at 1.2 percentage point, followed by Region III (Central Luzon) with a 1.1 percentage point decrease, and Region XI (Davao Region), recorded a 1.0 percentage point decrease.

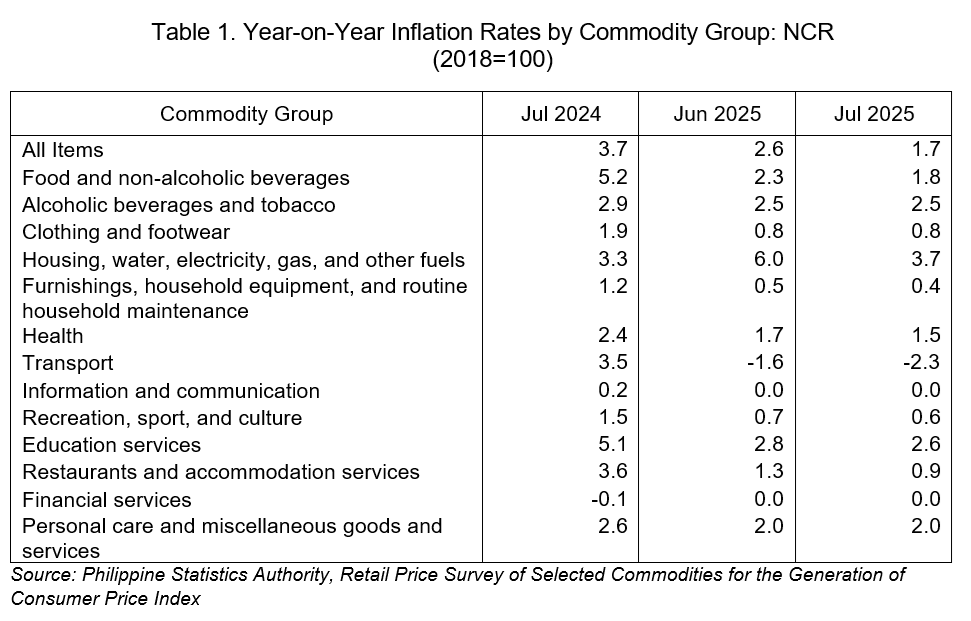

Housing, water, electricity, gas, and other fuels contribute to the slower inflation rate in NCR

The slower inflation in NCR was primarily driven by the housing, water, electricity, gas, and other fuels index, which decreased from 6.0 percent in June 2025 to 3.7 percent in July 2025. This contributed approximately 70.1 percent share overall decrease in inflation.

The index of food and non-alcoholic beverages was the second-largest contributor to the region’s deccelerating inflation which decreased from 2.3 percent in June 2025,

to 1.8 percent in July 2025. This was followed by the index of transport, which dips to negative 2.3 percent during the month from negative 1.6 percent in the previous month.

Likewise, gradual annual decline during the month were observed in the indices of the following commodity groups:

Furnishings, household equipment and routine household maintenance,

0.4 percent;Health, 1.5 percent;

Recreation, sport and culture, 0.6 percent;

Education Services, 2.6 percent; and

Restaurants and accommodation services, 0.9 percent.

Meanwhile, the indices for the remaining commodity groups stayed at their respective annual rates in June 2025.

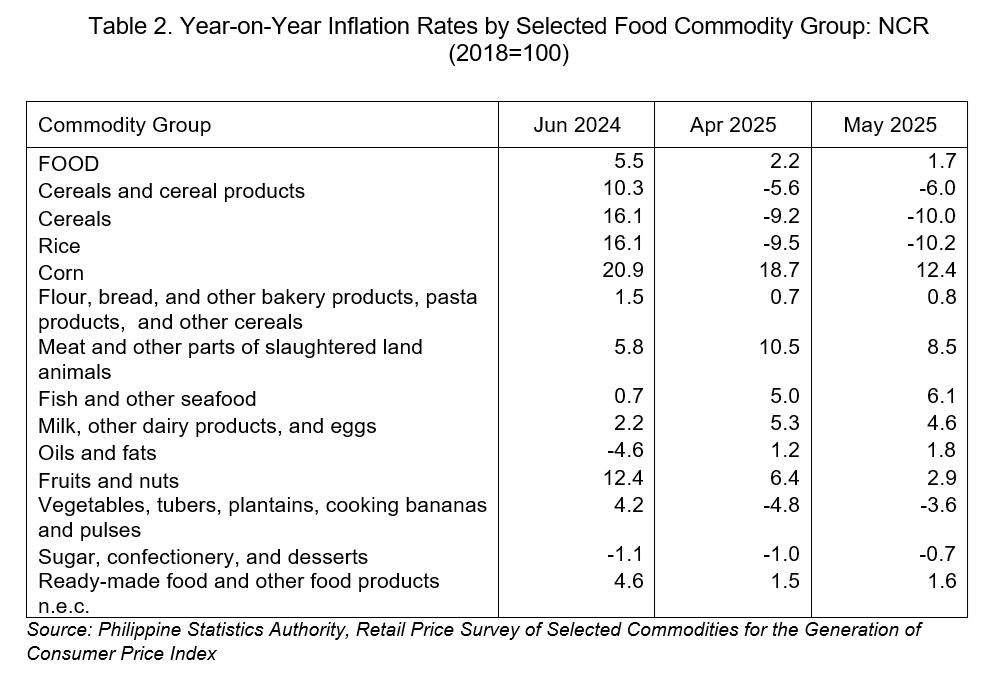

Food Inflation in NCR subsides to 1.7 percent

The food inflation in the NCR subsided to 1.7 percent in July 2025 far below the 5.5 percent inflation rate posted in July 2024. Morever, slower annual decrease were observed in the indices of meat and other parts of slaughtered land animals at 8.5 percent; followed by fruits and nuts at 2.9 percent; and rice at negative 10.2 percent.

Likewise, the annual decrease during the month were observed in the indices of corn at 12.4 percent, and milk and other dairy products, and eggs at 4.6 percent.

On the contrary, upticks on its annual rate were observed in the indices of:

Flour, bread and other bakery products, pasta products, and other cereals, 0.8 percent;

Fish and other seafood, 6.1 percent;

Oils and fats, 1.8 percent;

Vegetables, tubers, plantains, cooking bananas, and pulses, negative 3.6 percent;

Sugar, confectionery and desserts, negative 0.7 percent;

6. Ready-made food and other food products n.e.c. at 1.6 percent.

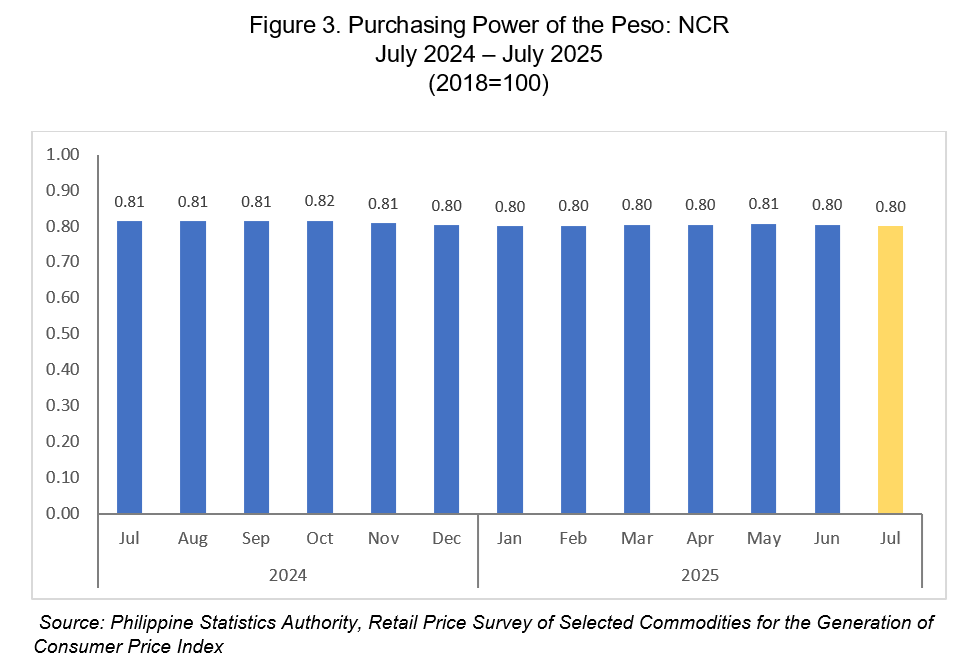

Peso purchasing power remains at 0.80

The Purchasing Power of the Peso (PPP) in the region remained to 0.80 in July 2025. This means that the real value of PhP1.00 in 2018 prices is equivalent to PhP0.80 in July 2025. In comparison, the PPP in NCR was slightly higher at 0.81 in July 2024, indicating a gradual decline in the peso’s purchasing power over the past year. (Figure 3)

The PPP is inversely related to the CPI; thus, an increase in the CPI will result in a decrease in the PPP.

(Sgd.)PACIANO B. DIZON

Regional Director